louisiana estate tax rate

Returns and payments are due on May 15th of each year on the preceding years income or on the 15th day of the fifth month after the close of the taxpayers fiscal period. The average effective property tax rate in East Baton Rouge Parish is 061 which is over half the national average.

Louisiana Inheritance Laws What You Should Know Smartasset

Louisiana collects a state income tax at a maximum marginal tax rate of spread across tax brackets.

. Below we have highlighted a number of tax rates ranks and measures detailing Louisianas income tax business tax sales tax and property tax. Resident ial 10 co mmercial 15 and public service 25. Calcasieu Parish collects fairly low property taxes and is among the lower 25 of all counties in the United States ranked by property tax.

Louisiana has one of the lowest median property tax rates in the United States with only states collecting a lower median property tax than Louisiana. In Louisiana the tax rate is not stated as a percentage but rather as a millage which is expressed in mills thousandths of a dollar per dollar. The first step towards understanding Louisianas tax code is knowing the basics.

Located in southeast Louisiana adjacent to the city of New Orleans Jefferson Parish has a property tax rate of 052. There is also the Louisiana homestead exemption for anyone who owns and occupies their. The Lousiana state auditor is Michael J.

Compared to the nationwide 107 average effective property tax rate Louisiana has a generous rate at 053. The average effective rate is just 051. Sales Taxes like most states Louisiana has both a state and local sales tax.

Louisiana has some of the lowest property tax rates in the US as only Alabama and Hawaii residents pay less on average than residents of the Pelican State. Louisiana has recent rate changes Tue Oct 01 2019. This rate is based on a median home value of 180500 and a median annual tax payment of 940.

Agricultural horticultural marsh and timber lands are assessed. Louisianas median income is 54216 per year so the median yearly property tax paid by Louisiana residents. Notably Louisiana has the highest maximum marginal tax bracket in the United States.

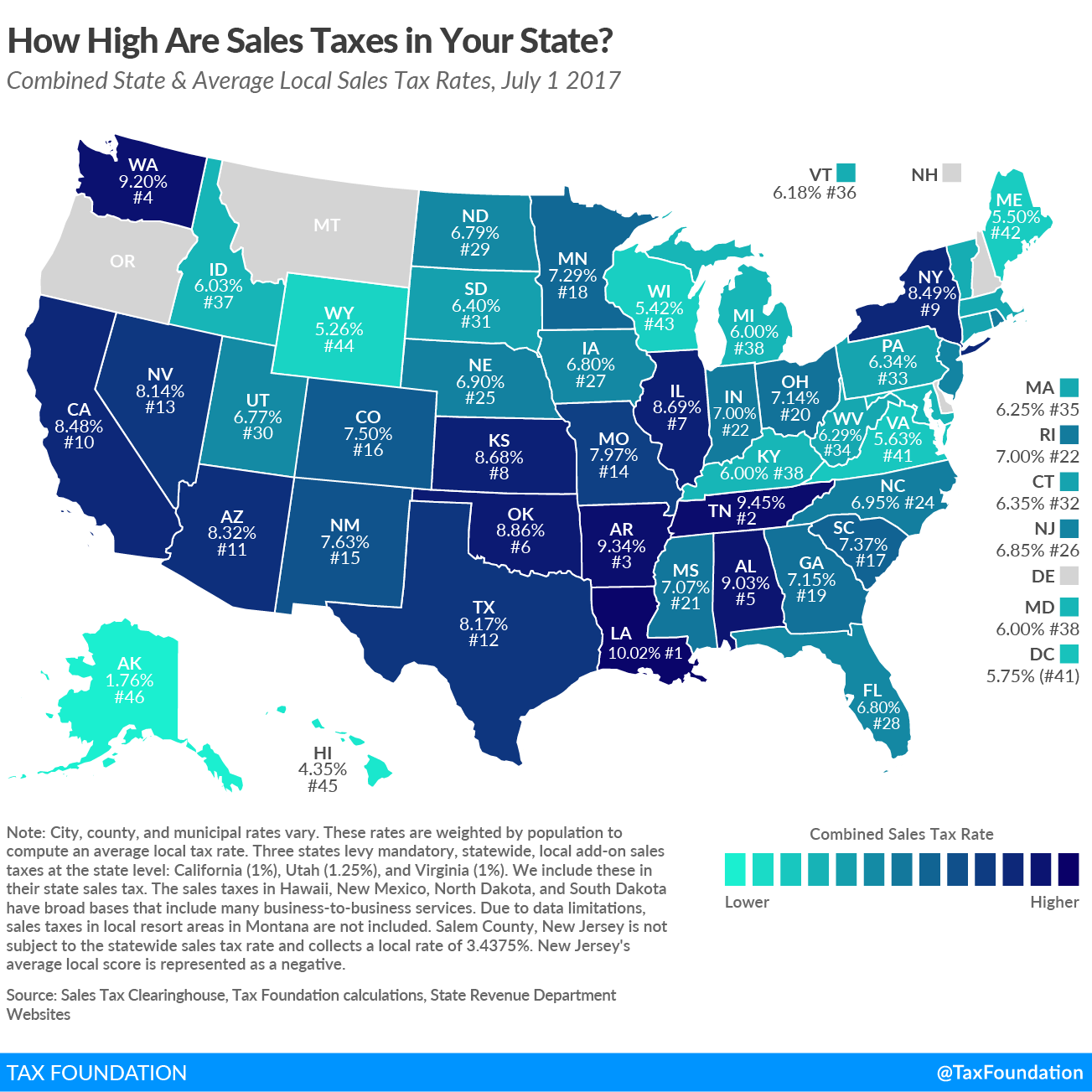

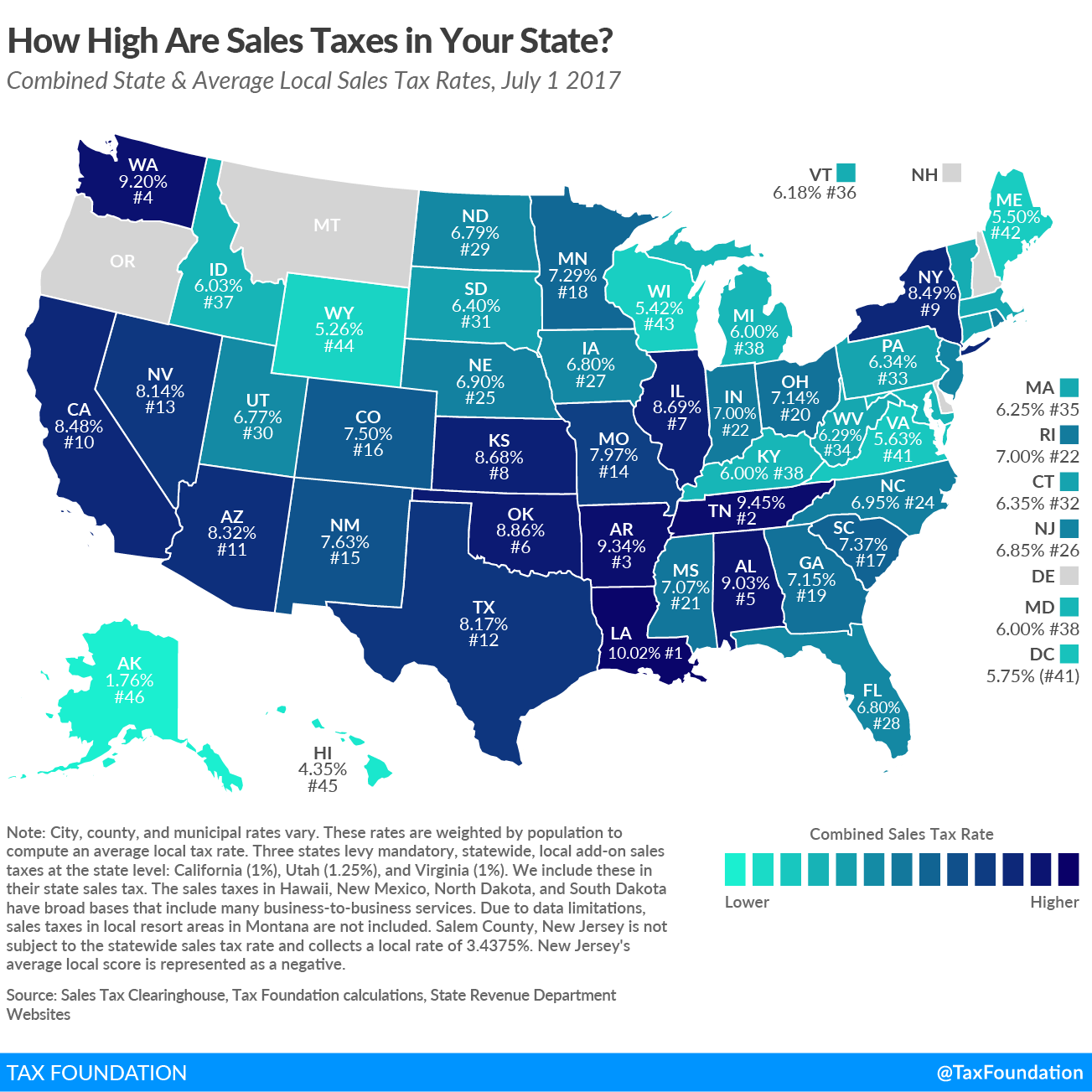

On average a homeowner pays 505 for every 1000 in home value in property taxes with the average Louisiana property tax bill adding up to 832. This interactive table ranks Louisianas counties by median property tax in dollars percentage of home value and percentage of median income. Its state sales tax is 445 and its local sales tax has an average rate of 507 which puts the state average 952.

Like the Federal Income Tax Louisianas income tax allows couples filing jointly to pay a lower overall rate on their combined income with wider tax brackets for joint filers. 1 dime 010 or 110 of 1. Lease or rental of any item.

At just 053 Louisiana has the fifth lowest. Select the Louisiana city from the list of popular cities below to. Median property tax is 24300.

With local taxes the total sales tax rate is between 4450 and 11450. The portion of the state death tax credit allowable to Louisiana that exceeds the inheritance tax due is the state estate transfer tax. In Louisiana theres a tax rate of 2 on the first 0 to 12500 of income for single or married filing taxes separately.

Such estates or trusts may elect to be taxed at the rate of five percent on total gross income from Louisiana sources. The sales tax rate in Louisiana is 445 and it applies to transactions involving the. Use distribution storage or consumption of tangible personal property.

Louisiana has state sales tax of 445 and allows local governments to collect a local option sales tax of up to 7There are a total of 263 local tax jurisdictions across the state collecting an average local tax of 5076. The following types of property are assess ed based on fair m arket val ue. Ad Compare Your 2022 Tax Bracket vs.

How does Louisiana rank. 31 rows The state sales tax rate in Louisiana is 4450. Your 2021 Tax Bracket to See Whats Been Adjusted.

Louisiana has the 2 nd highest sales tax in the country behind Tennessee. The median property tax also known as real estate tax in Calcasieu Parish is 29600 per year based on a median home value of 10940000 and a median effective property tax rate of 027 of property value. Discover Helpful Information and Resources on Taxes From AARP.

Sale of tangible personal property. Compare your take home after tax and estimate your tax return online great for single filers married filing jointly head of household and widower. The Louisiana Legislative Auditors mission is to foster accountability and transparency in Louisiana state government by providing the Legislature and others with audit services fiscal advice and other useful information.

Sale of certain services such as hotel rooms admissions to facilities parking privileges laundry services storage. The list is sorted by median property tax in dollars by default. However because of the varying tax rates between taxing districts the average tax bill fluctuates from parish to parish.

Counties in Louisiana collect an average of 018 of a propertys assesed fair market value as property tax per year. Click here for a larger sales tax map or here for a sales tax table. Combined with the state sales tax the highest sales tax rate in Louisiana is 1295 in the city.

If youre married filing taxes jointly theres a. The Economic Growth and Tax Relief Reconciliation Act of 2001 phased out the state estate tax credit between 2002 and 2005 and replaced the credit with a deduction for state estate taxes for deaths that occur. Louisiana has the third lowest property tax rates in the nation.

2022 Louisiana Tax Tables with 2022 Federal income tax rates medicare rate FICA and supporting tax and withholdings calculator. Sales and Property Taxes in Louisiana. Rate and basis for assessing property values The rate used in determining assessed value differs depending on the type of property.

Thinking About Moving These States Have The Lowest Property Taxes Property Tax Estate Tax Tax

Paradym Fusion Viewer Real Estate Trends Realtor License Outdoor Structures

Louisiana Retirement Tax Friendliness Smartasset

Louisiana Inheritance Tax Estate Tax And Gift Tax

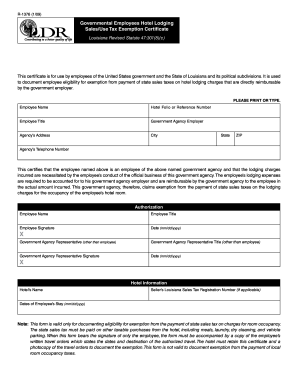

Louisiana Hotel Tax Exempt Form Fill Online Printable Fillable Blank Pdffiller

Estate Taxes New Orleans Orleans Parish Louisiana Lawyer Attorney Law Firm

If You Want To Avoid Paying Lots Of Taxes You Might Want To Steer Clear Of The Northeast And Venture Towards Th Best Places To Retire Retirement Locations Map

America S 15 States With Lowest Property Tax Rates House Prices Louisiana Homes Property Tax

Louisiana Sales Tax Rate Remains Highest In The U S Legislature Theadvocate Com

Louisiana Retains Title For Highest Combined State And Local Sales Taxes

Louisiana Property Tax Calculator Smartasset

Louisiana La Tax Rate H R Block

How To Finally Write Your Will 1 3 Smart Finances Estate Planning Help Save Money

Louisiana Sales Tax Small Business Guide Truic

Sales Tax Rate By State Income Tax Map Property Tax

Historical Louisiana Tax Policy Information Ballotpedia

Analysis Shows Louisiana Has Highest Combined Sales Tax In U S Biz New Orleans