are nursing home fees tax deductible in uk

These refunds can be worth between 50000 and 100000 and include interest so its worth having a closer look to see if you can claim. If payments are made directly by the provider to the care home then these payments are tax free.

Tax Documents Checklist Papers Organizing Home Organizer Paper Organization Free Printables Organization Organization

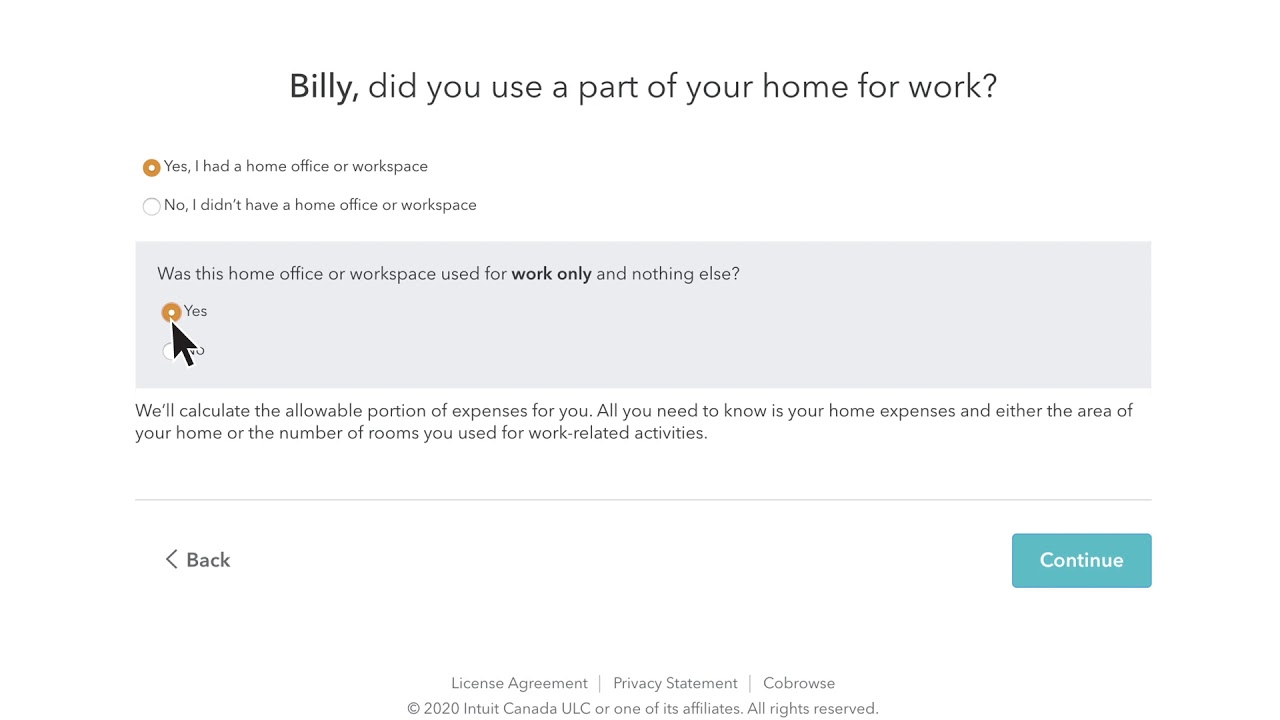

You can deduct some of these costs to work out your taxable profit as long as theyre allowable expenses.

. Nursing home care. Tax relief on nursing home fees You claim tax relief for nursing home fees under the general scheme for tax relief on medical expenses. This is a contribution towards the cost of your nursing needs.

You can claim this relief as a deduction from your total income if the nursing home provides 24-hour on-site nursing care. Claiming tax relief on your registration fee HM Revenue and Customs HMRC allow individuals to claim tax relief on professional subscriptions or fees which have to be paid in order to carry out. If you move back to your.

If you are a self-funder and paying all your own fees which include nursing costs FNC might be deducted from the total bill. Typical care home fees ranged from 511 a week in the north-west of England to 741 a week in London. An adjusted gross income AGI of 5 percent is a tax on profit.

Home care fees. The 10660 tax free allowance is reduced by 1 for every 2 of taxable income above 25400 but cannot fall below the basic personal allowance of 8105. How much you can claim will depend on a number of factors including how much your annual fees cost and your tax situation.

The costs of qualified long-term care including nursing home care are deductible as medical expenses to the extent they along with other qualified expenses exceed 75 of. This means that the portion of your income which is. Fees and subscriptions to some professional bodies.

Watch Are Care Home Costs Tax Deductible Uk Video. Nursing Home Expenses Relief. Deducting Medical Expenses Health.

You cant claim back fees or subscriptions for. Example Your turnover is 40000 and you claim 10000 in allowable expenses. The average cost of a care home is.

There is little recognition of the costs of older people There is one exemption for inheritance tax payments you have made for the care of a dependent relative. The monthly average cost of. Consider a deferred payment agreement If.

Ask a UK tax advisor for answers ASAP. If you your spouse or your dependent is in a nursing home primarily for medical. The average cost of care in Scotland is 760 per week which equates to just under.

So if you pay basic rate tax at 20 you could claim 12 tax relief on the total 60 flat-rate deduction. Moreover the Plan is portable and can move from home to home. Free Care Home Shortlist Expert Advice - Online and on the Phone.

The honest answer is there is absolutely no guaranteed way to avoid care charges completely. You can claim this relief at your highest rate of. If you or your spouse or civil partner need nursing home care there are schemes you can apply for.

As a guide members who pay basic rate Tax in the UK can. Up to 15 cash back UK Tax. Answer Yes in certain instances nursing home expenses are deductible medical expenses.

Connect one-on-one with 0. Understanding this will give you a better idea of where your fees are going. The average weekly cost of living in a residential care home is 704 while the average nursing home cost is 888 per week across the UK.

Ad The Largest Most Detailed Care Home Nursing Home Directory for Older People in the UK. We are here to help. Are privately funded nursing home fees tax.

If you are seeking to deduct the costs of a nursing home or assisted living facility you might be able to deduct anything that exceeds 75 of your income. Its paid directly to the care home and the amount should be deducted from your bill. If you are paying the nursing home fees you can get the tax relief whether you are in the nursing home yourself or you are paying for another person to be there.

In the UK a normal care home fee breakdown typically looks something like this. Add in an element of nursing care and the costs rise to 776 and 949. You can claim tax relief.

50 goes to staff. You will be expected to pay towards the cost from your income included in the financial assessment for example pensions however you must be left a Personal Expenses Allowance. However different care homes have different.

Home Office Deductions For Self Employed And Employed Taxpayers 2022 Turbotax Canada Tips

Canadian Tax Return Check List Via H R Block Ca Http Www Hrblock Ca Documents Tax Return Do Small Business Tax Deductions Tax Prep Checklist Business Tax

75 Items You May Be Able To Deduct From Your Taxes

The Ultimate Self Employed Deduction Cheat Sheet Exceptional Tax Services Small Business Tax Deductions Business Tax Deductions Tax Services

20 Overlooked Unusual Tax Deductions You May Be Eligible For Tax Deductions Small Business Tax Deductions Business Tax Deductions

Home Office Deductions For Self Employed And Employed Taxpayers 2022 Turbotax Canada Tips

Does Your Parent Qualify As A Tax Deduction The Savvy Age Tax Deductions Family Caregiver Deduction

Ebitda Stands For Earnings Before Interest Tax Depreciation And Amortisation It Is A Profitability Kpi C Finance Blog Small Business Accounting Finance Advice

Filing Your Tax Return Don T Forget These Credits Deductions National Globalnews Ca Small Business Tax Business Tax Bookkeeping Business

The Master List Of All Types Of Tax Deductions Infographic Business Tax Deductions Small Business Tax Business Tax

Can I Get A Student Loan Tax Deduction The Turbotax Blog

Did You Know Personal Health Insurance Premiums Are An Eligible Tax Deductible Expense In Ontario Ontario Blue Cross

What Is A Pre Tax Deduction A Simple Guide To Payroll Deductions For Small Business

Home Office Deductions For Self Employed And Employed Taxpayers 2022 Turbotax Canada Tips

From 6 April 2017 The Tax Relief That Residential Landlords Receive On The Costs Of Finance For Uk Re Property Investor Investment Property Property Management

Top Tax Planning Tips For 2019 Income Tax Audit Services Tax

Super Helpful List Of Business Expense Categories For Small Businesses Based On The Sc Small Business Bookkeeping Small Business Tax Small Business Accounting

Small Business Tax Spreadsheet Business Worksheet Small Business Tax Deductions Business Tax Deductions