do you pay property taxes on a leased car in ct

Do I pay taxes on my leased vehicle. If the lease agreement states that you are responsible for these taxes you will receive an invoice from the.

Who Pays The Personal Property Tax On A Leased Car

In all cases the tax advisor charges the taxes to the dealer and the dealer pays.

. The monthly payment and down payment are only taxed at sales tax. According to a tax collector in Providence tax bills are usually billed to leasing companies. A factory represents one dollar in taxes for every property value estimated at 1000.

The sales tax is 775 percent for vehicles over 50000. This is what you agreed to at the time of lease inception. However the bill is mailed directly to the leasing company since leased cars are registered in the companys.

Privately owned and leased vehicles are subject to Massachusetts excise tax which municipalities levy based on a vehicle s value and a statutorily determined tax rate. All tax rules apply to leased vehicles. If the costs assessed to you are not in your original contract you may.

The Farmers Tax Exemption Permit form. 170 rows The local property tax is computed and issued by your local tax collector. The property tax liability for a motor vehicle that is leased rather than sold outright to someone remains with the business that holds title to the vehicle ie the.

The sales tax is 635 percent for vehicles purchased at 50000 or less. If you do not register a motor vehicle but retain ownership you must annually file a declaration form with. For instance if your monthly payments reach 500 a month for three years and youre required to pay 7 percent sales tax on the vehicles entire value youll end up paying an extra 1260 in.

Owners of vehicles registered between October 2 and July 31 pay a prorated amount depending on the. If personal property taxes are in effect you must file a return and declare all. There may be costs involved that you are responsible for.

This could include a car which in most households is a relatively valuable property. As a result the lease agreement would most likely require the tax to be paid by the. When you lease a vehicle in Connecticut you are not required to pay sales tax on the vehicles total value.

Do You Have To Pay Taxes On Your Car Every Year Carvana Blog

Leasing A Car What Fees Do You Pay At The Start Of A Lease Autotrader

Who Pays The Personal Property Tax On A Leased Car

Free Vehicle Lease Agreement Make Sign Rocket Lawyer

What You Should Know About Leasing A Car In Ct Ct Sales Tax On Cars

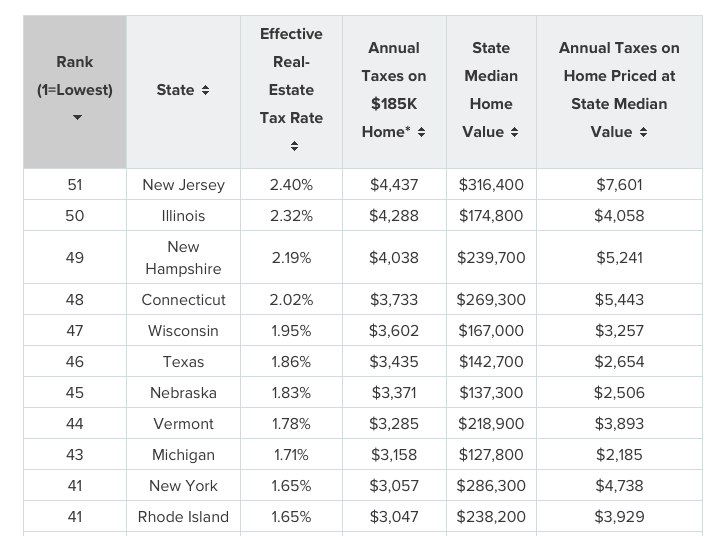

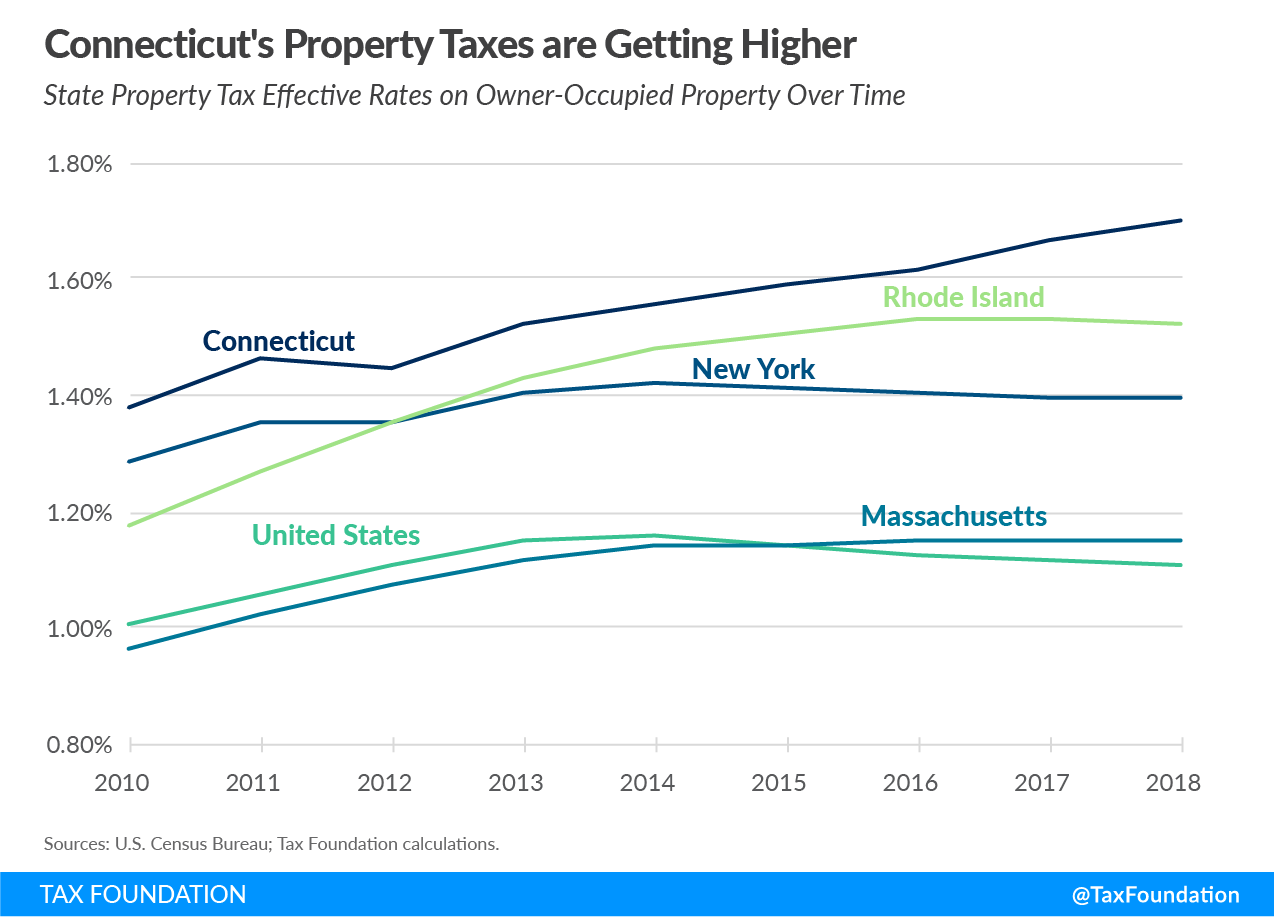

Connecticut Ranked 48th For Property Taxes As State Deficits Threaten To Drive Them Higher Yankee Institute

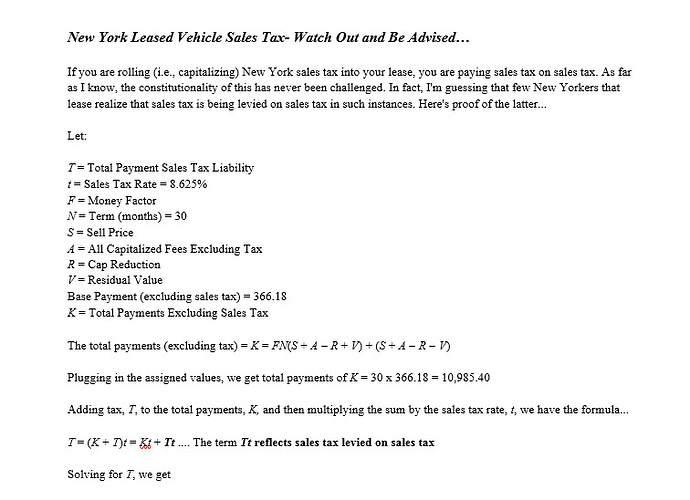

Sales Tax In Ny Off Ramp Forum Leasehackr

What Is A Lease Buyout Keep Your Leased Car Or Sell It Nerdwallet

What S The Car Sales Tax In Each State Find The Best Car Price

Leasing A Car What Fees Do You Pay At The Start Of A Lease Autotrader

Bmw Lease End Information Bmw Usa

Connecticut Property Tax Limitations What Ct Can Learn From Neighbors

What S The Car Sales Tax In Each State Find The Best Car Price

Tangible Personal Property State Tangible Personal Property Taxes

Is It Better To Buy Or Lease A Car Taxact Blog

What S The Car Sales Tax In Each State Find The Best Car Price

Returning A Leased Car After An Accident Benson Bingham

Do I Have To Pay A Car Tax On A New Or Used Car Credit Karma